Instamojo's next innovation in link-based commerce: Smart Links

Payment Links, launched in 2016, achieved the product-market fit for Instamojo. Lakhs of MSMEs use Payment Links to collect payments every day.

Our products are self-explanatory; we spend no money on activating a customer. 80% of our customers adopt our DIY products within 55 minutes of Signing up.

Payment links & buttons are on the customer's website; before the competition picks up the phone to call.

Customers always want more. We love that about our customers— they expect Instamojo to get better. Speaking to them we learned that Payment Links are good but "it could be better". ❤️

The Problems

Businesses use Payment Links to close sales. Their customers raise a query over a call, WhatsApp/Instagram chat, SMS, etc. They send Payment links to their customer once the price is final.

As these businesses grow, they become complex. New departments, processes, and software emerge. Payment Links often need tech-effort to make it work.

From being a pain-killer, Payment Links could become a pain.

Making sense of customer requests

Our customers range from individuals to companies serving pan-India. We were getting hundreds of feature requests from them.

The customer is always right - about the problems they face and they trust professionals to find the right solutions.

While taking note of their feature requests, we discussed:

- Why they wanted the feature. What problem would it solve for them?

- How do they solve the problem today?

- If we had the feature today, what else would they need to switch from their existing solution?

It's not enough to take a feature request and build it. There will be no adoption if the switching cost is high.

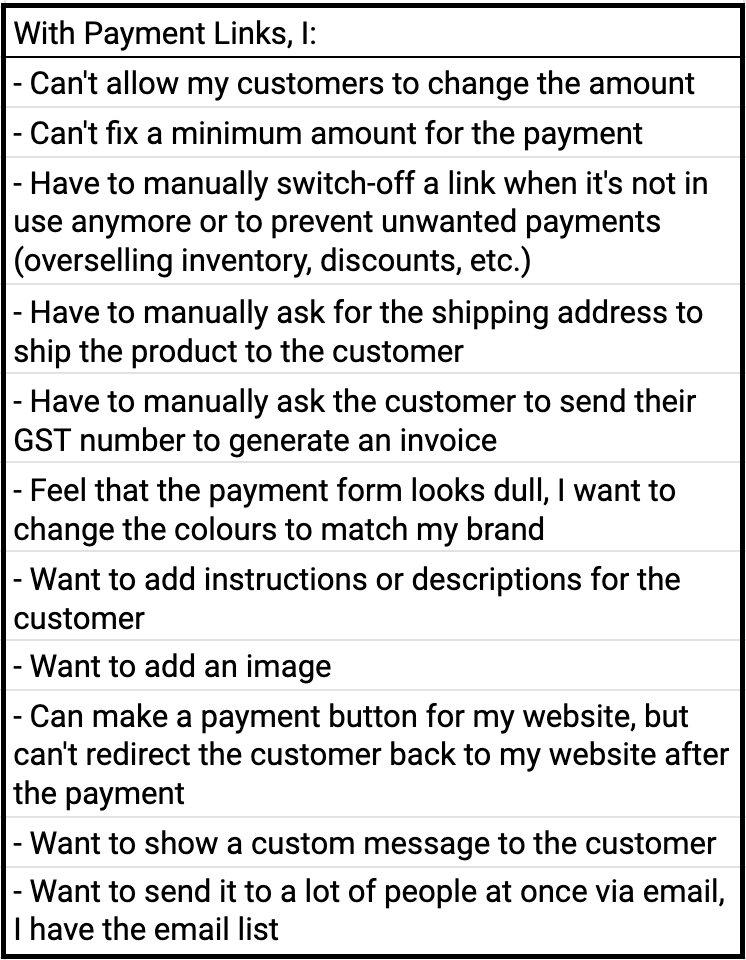

Speaking to them, we learned these were the most important problems they wanted us to solve:

- Dynamic payment amount & timing: Eg: Advance payment for a commissioned work, early bird/discounted tickets for an event, etc

- Data collection with payment: Businesses have a stack of departments to deliver the end results. Each department needs data to work. Eg: warehouse, shipping, admission department in school/colleges, etc

- Looking professional & trustworthy: businesses wanted the change the design & content. This would ensure consistency with their brands

Out of the umpteen feature requests, we chose to prioritise 15 critical ones. How do we fit that without making everything overwhelming?

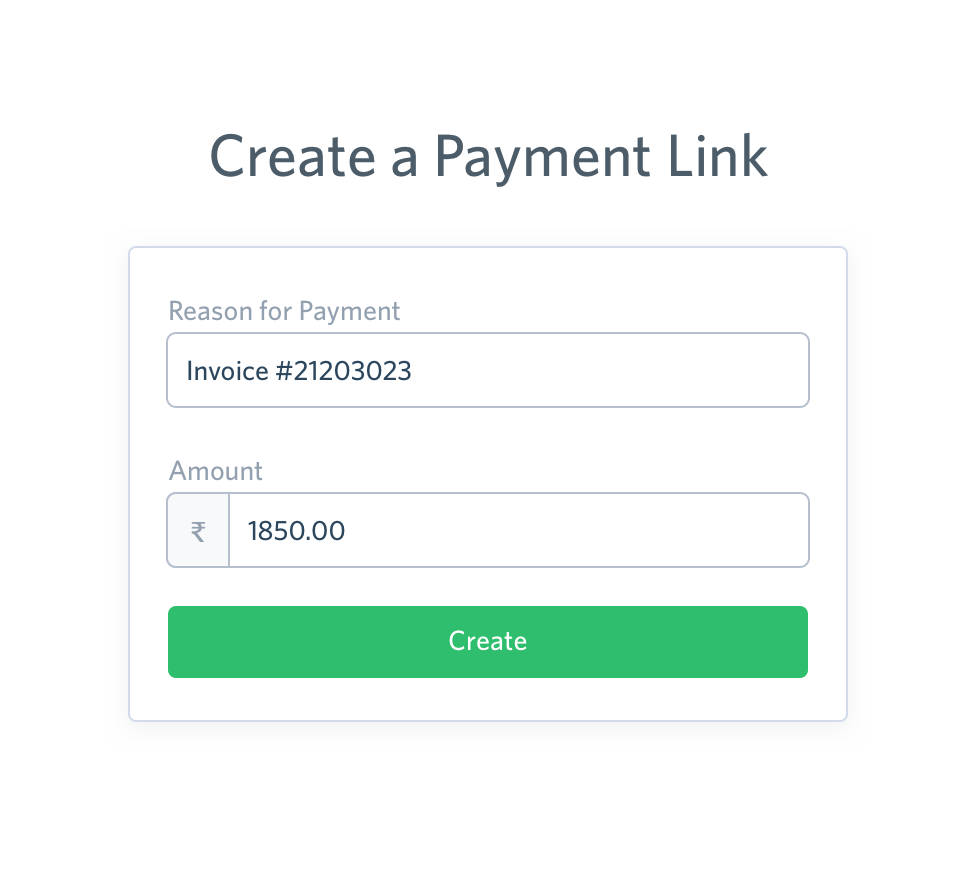

How do we fit this...

...into this...

...and keep the experience easy & simple?

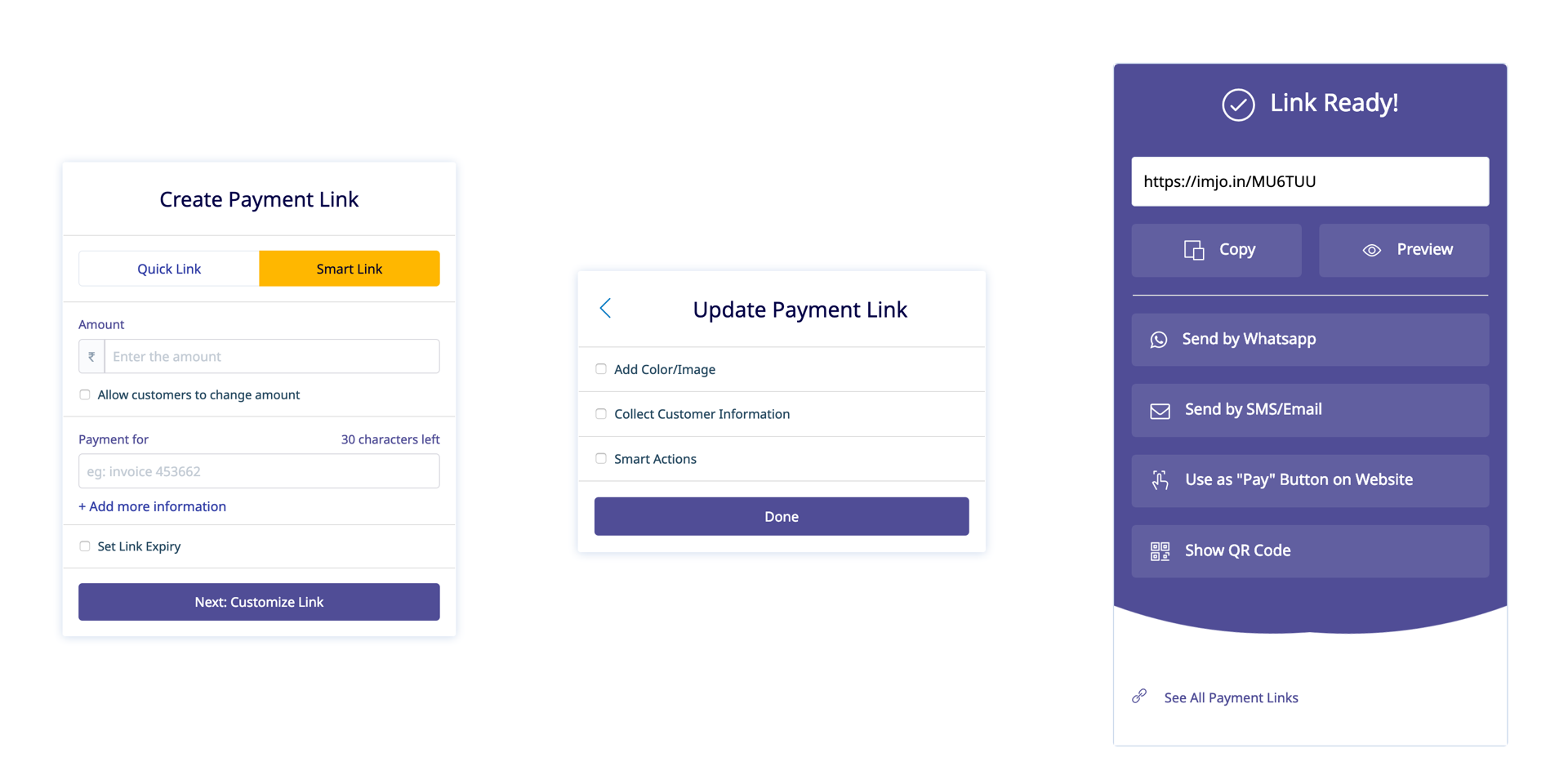

Our design team, Mohamed Ansari & Sreenath Kotteri, took this challenge and created magic for our customers. ( Mohamed talks about interaction design process detail here ).

Creating a Smart Link is as simple as creating a Payment Link (reanamed to Quick Links).

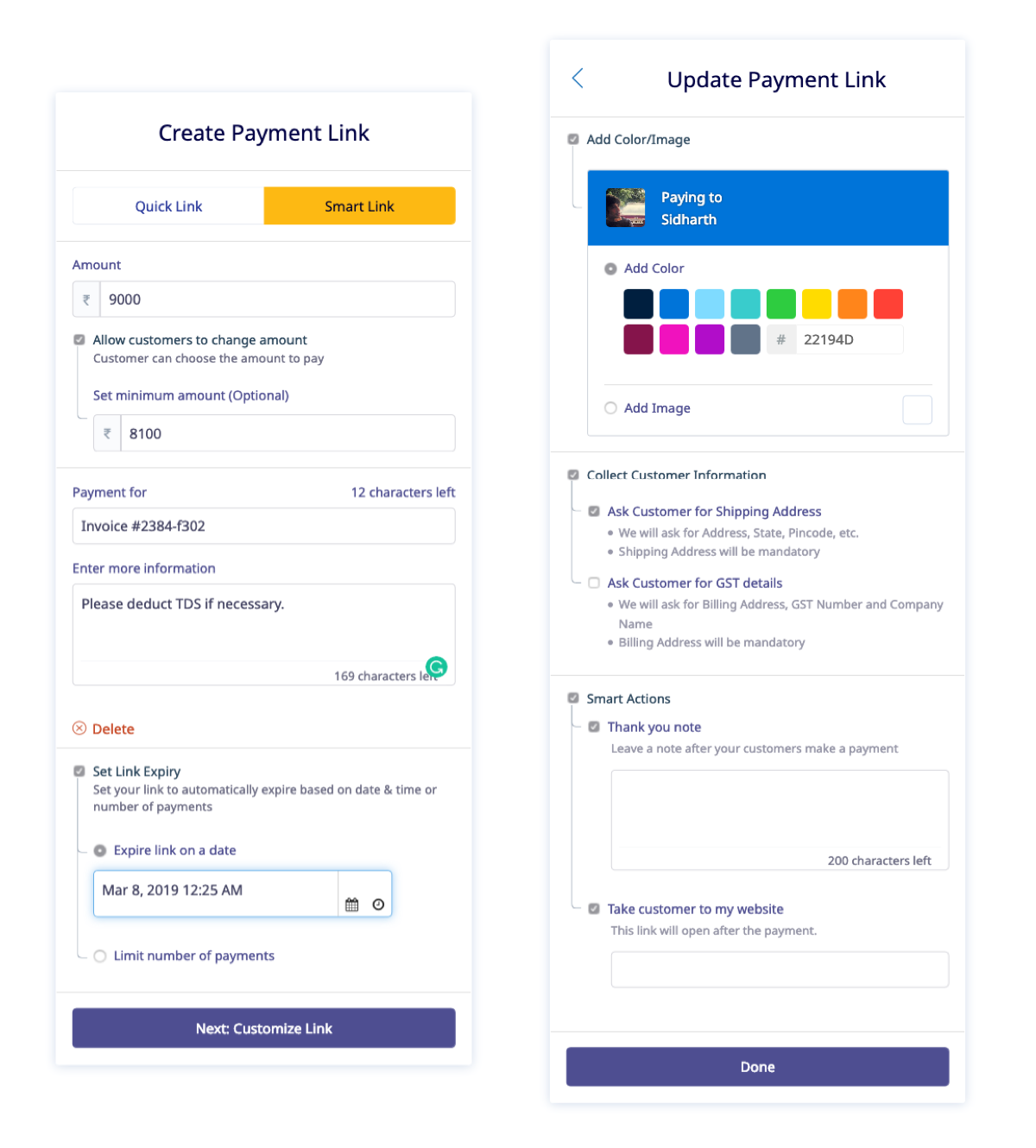

When creating a Smart Link:

- Business critical features come first. Eg: amount, expiry date, etc

- Everything else is optional and grouped where the feature had similar end results. Eg: Data collection features are in one group

While it's simple, it covers everything our customers asked for:

The "Smart" in Smart Links

Smart Links are not about more features. They are smart because they understand the intention behind the feature.

Let's take a feature request from our list earlier:

At first, the problem seems to be simple—give a checkbox to collect GSTN?

But the real problem is invoicing. There are other data required for invoicing, apart from the GST Number:

- Billing Address (important for GST Invoicing)

- Shipping Address (sale of a product that requires shipping)

- Billing & Shipping Addresses may be different.

- Company Name

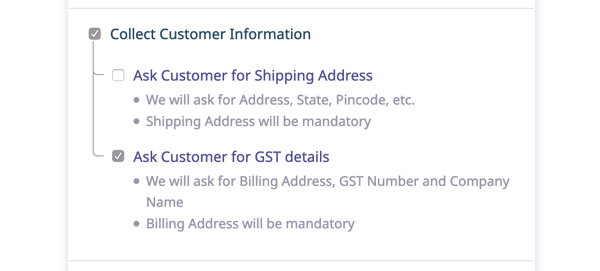

By clicking one checkbox, the business can take care of all these use cases:

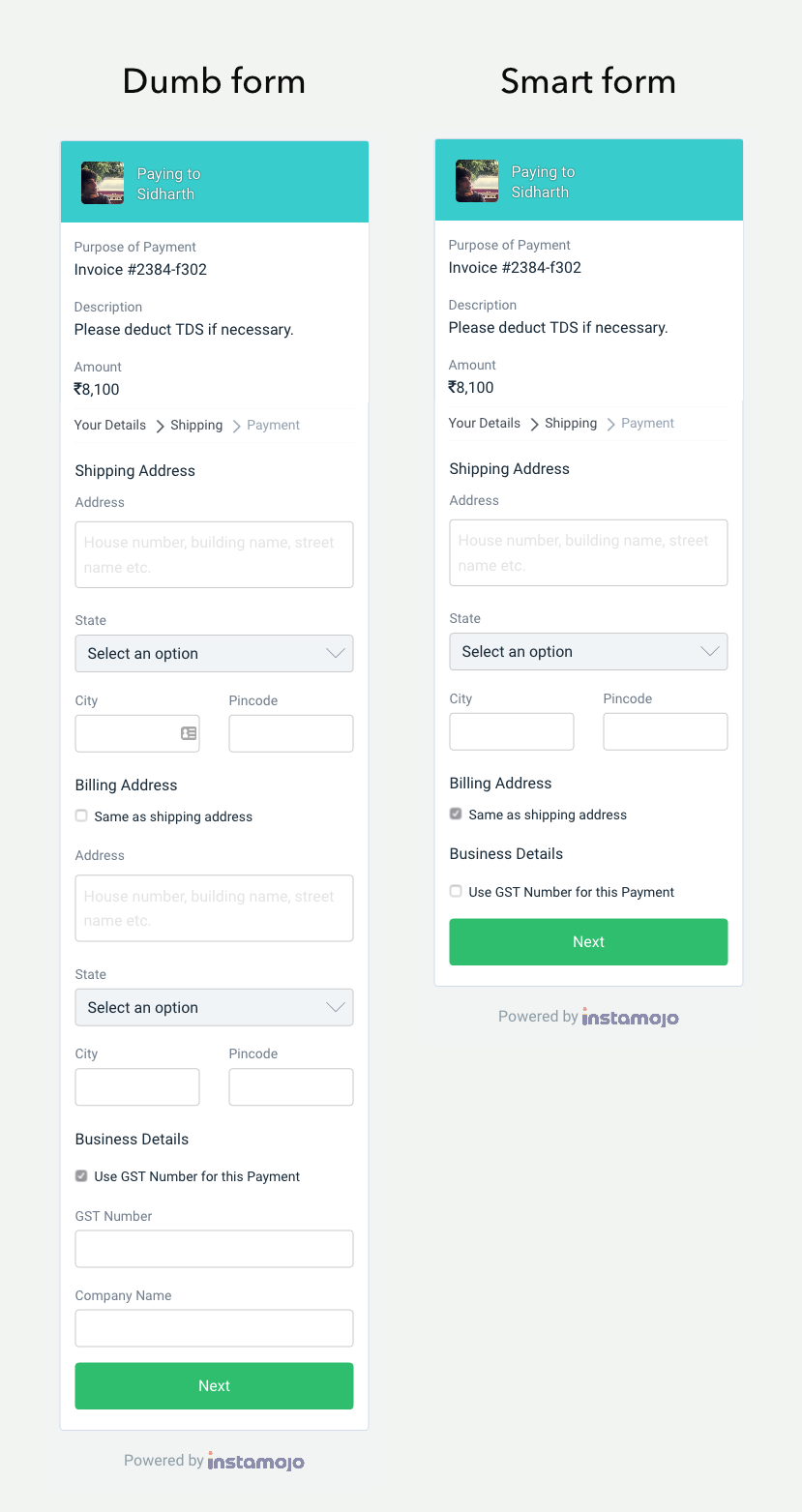

This creates a problem for the payment experience. The customer making the payment would have to fill 10 fields:

-

Shipping Address:

- Street Address

- State

- City

- Pincode

-

Billing Address:

- Street Address

- State

- City

- Pincode

- GSTN

- Company Name

Smart Links take care of that as well. The only mandatory fields for the customer are the address fields. Everything else is optional:

Every feature in Smart Links is smart like that 😎.

Results

Within 60 days of launch, 7% of our monthly active users (MAU) adopted Smart Links with zero budget spent on marketing.

They created beautiful Smart Links:

We saw better adoption in the categories we researched & targeted with Smart Links. Smart Link users are serious and more likely to use our value-added services.

Defending margins

Smart Links solve problems for lakhs of businesses and their customers. It also adds to Instamojo's competitive advantage in the payments business.

Consider two things:

First, there are companies dedicated to solving the problems we aim to solve with Smart Links. (Dynamic Pricing, Data Collection, and Landing Pages)

Most of these companies offer their software on a subscription model (SaaS). MSMEs have an unpredictable cash flow and don't like a monthly/yearly subscription fee. The software is often too complicated to understand & use.

Second, the payments business is a low-margin business. With high competition in the market, most payment products suffer margin erosion. Especially when focused on big-ticket customers, where the customer has the pricing power.

Smart Link solves both these problems:

For the MSME, it brings the essentials from SaaS products at a predictable price. Pay when you use — they pay 2% + Rs.3 per transaction — no subscription & no upfront cost.

When they can afford the paid SaaS products, they use webhooks to integrate Payment Links with their favourite products.

...

For our customers, we are more than a payment gateway, shipping gateway, or loan gateway. We are partners in their business.

While our competition has to slash prices to acquire & retain customers, our customers are happy to pay more for the problems we solve.

Credits

- Interaction Designer - Mohamed Ansari

- Product Designer - Sreenath Kotteri

- Thank you for proof-reading & editing - Rapti Gupta

You are reading a post that I wrote a long time back—at least 5 years ago. Take it with a bag of salt.

About Sidharth · Listen to the Podcast · Talks