Next Day & Instant Payouts: habit building credit lines for businesses

"It takes too long for the money to reach my account."

Businesses use Instamojo to receive a payment. It takes up to 3 working days for the money to hit their bank account (payout). Settlement cycles are an industry standard (T+3 settlement cycle).

This delay is not a problem for a business with sound financial management and a steady cash flow, for a small business, cash can dry up fast. The problem hits hard when:

Surviving the Cash Crunch

Credit lines from banks are inaccessible to small businesses. For a bank it's not profitable to focus on small customers. Business owners are also not keen on the lengthy paperwork that a bank requires; they'd rather focus on their business.

Instead, small businesses use personal savings to start the business and profits to grow it. Family is the only credit line, if they are well-off.

Our customers were not asking for faster payouts, they were asking us for a short term credit line to fund their business.

Solving the puzzle

Why can't the money come faster?

Instamojo gets settled in cycles up to T+3 business days. We couldn't transfer the money if it wasn't there. Banking infrastructure and regulations are often the bottleneck of innovation in our industry.

Manik Singla came up with — Next Day & Instant Payouts. As the name suggests, these products allow businesses to get money in their bank accounts next day or instantly.

Here's how we solved some key problems:

Where will the money come from?

Our partners (banks & gateways) take up to T+3 days to settle the money to us and sometimes it can take even longer. We cannot send someone the money that doesn't exist!

Credit/loan was the most obvious option. Lending money is the easy part, but recollection is hard. Especially when cash flow of the person/business paying back is unpredictable.

How much should we lend?

These products were targeted towards businesses with cash-flow problems. The cash-flow problems make them a good customer for a credit-line but also deters their ability to pay.

Our customers had the answer - "Just give me the money you owe me in advance."

They needed the money when an order came in. The credit limit was the payments they received.

When and how will the the repayment happen?

The loan is considered repaid when the T+3 cycle is completed. Instamojo receives the money from the upstream partners and settles it to the lender.

How much will it cost?

When we spoke to our customers they were clear -the price should be predictable. It makes the decision making easier.

For Instant Payouts it is 1% of the payout amount. However, for low-margin businesses the price was a deal breaker.

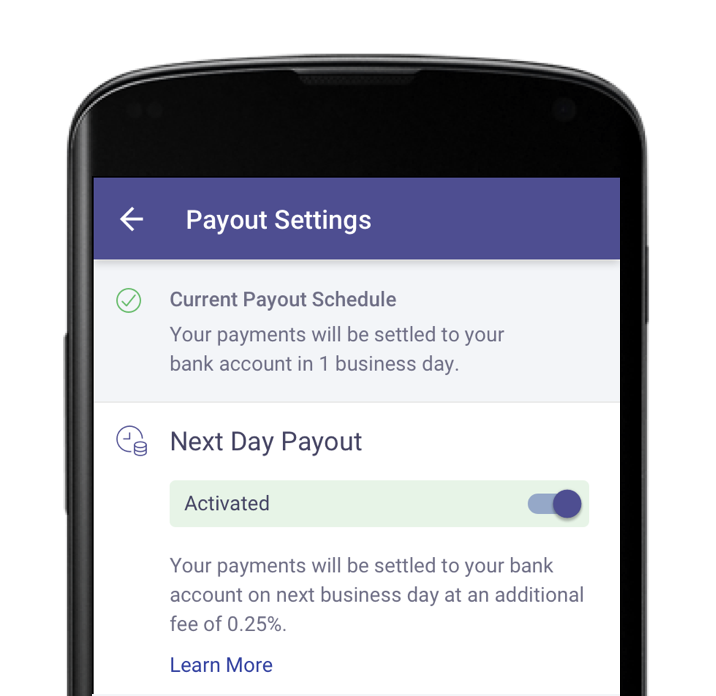

Next Day Payouts comes to the rescue - get the money in your bank tomorrow for just 0.25%. Now businesses can solve most of their cash flow problems with a little planning.

How will we send the money on bank holidays?

The standard way to send money to banks is NEFT/RTGS. NEFT doesn't work on holidays 🤷♂️😭.

We considered IMPS which works 24x7. Every payment could be instantly sent to the bank account. That could work if you're receiving 10 payments a day. It'd be a lot to deal with if you get 10 payments a minute.

So bundle them up? Sure but the transaction limit on IMPS is ₹2,00,000. So even more transactions?

We turned this design challenge into user delight.

Money at the click of a button

We explored the idea of scheduled payouts. Eg: payout all the payments 6 times a day.

But could we do better? It still may not solve the ₹2,00,000 limit problem. Another concern was the 1% charge. Businesses might not want to put that on auto-pilot.

We decided to make it a voluntary experience:

- Select the transactions you want a payout for

- Check charges & fee

- Click a button…

…and the money hits your bank account! Nothing is more delightful than money coming in.

This approach has three advantages:

- Users get to choose the exact amount they want to payout

- We can limit each payout to Rs. 2,00,000 (solving the IMPS problem!)

- Our risk analysis system gets more time to flag risky transactions

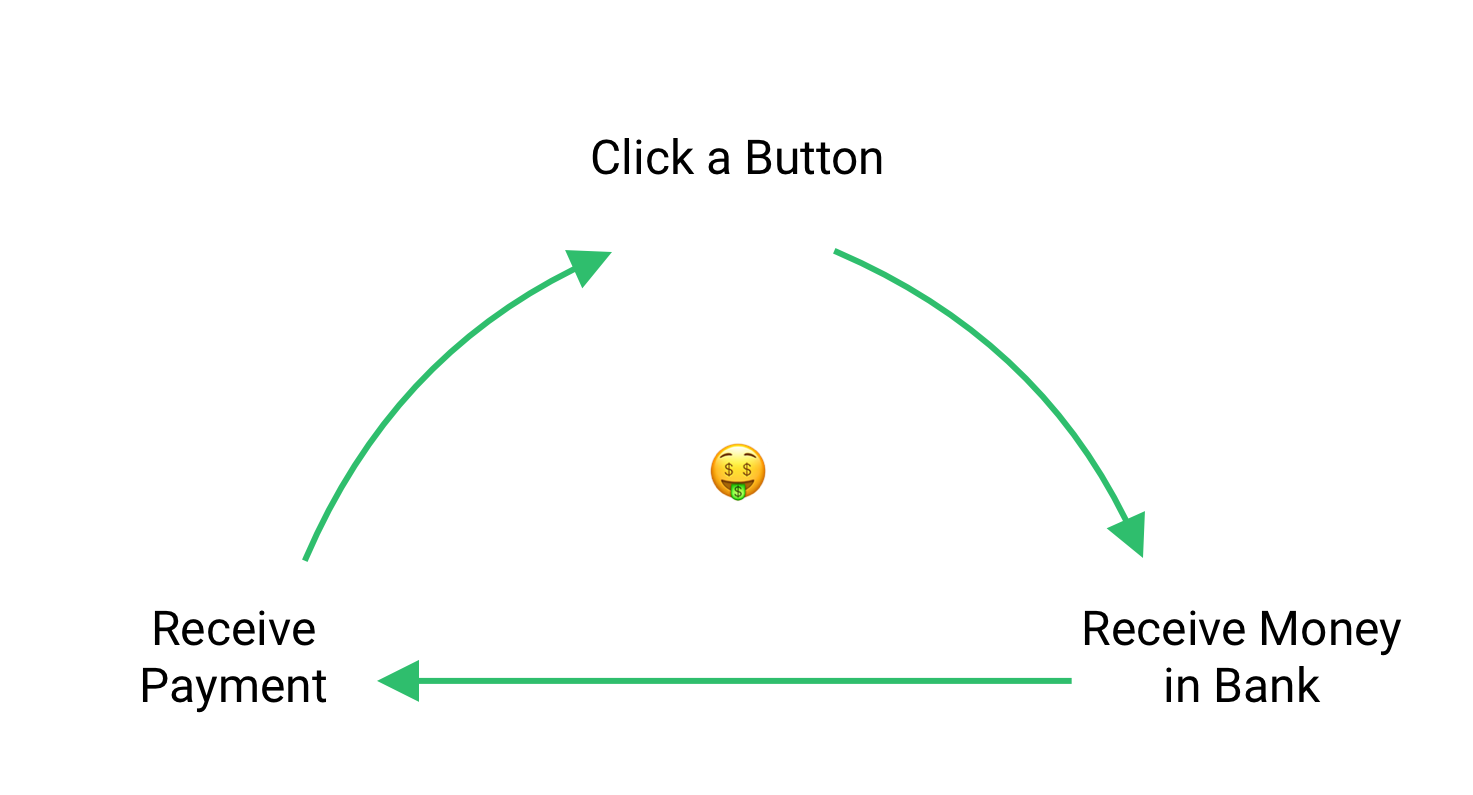

That's not all, Instant payout is also a habit building product.

The Habit Loop

Habit loop is based on Pavlovian conditioning: A cue that triggers you to take an action and the action has a predictable reward.

Do this several times over and it will become a habit. You can read more about habit loop here.

With Instant Payout, this is what the habit loop looks like:

Results

Customers love Instant Payout and Next Day Payout.

Businesses with low-margins or steady cash-flow prefer to switch on Next Day Payouts and forget about it. Others love Instant Payouts:

"I love Instant Payout, it's the icing on the cake."

- A baker who uses Instamojo

Within 60 days of launch we disbursed ₹10+ Cr in loan to our customers. This number has grown over 150% since then.

Excited to share, #mojoCapital crossed a huge milestone of INR 100+ million #SachetLoans disbursed & recovered within 2 months of launch 💪🏽🚀🇮🇳 pic.twitter.com/caZx587uTi

— sampad swain (@sampad) October 31, 2018

4 months later we disbursed ₹100+ Cr in total:

#SachetLoans now in the Rs 100+ crore club (annualized). We have already disbursed & recovered Rs 26 Cr+ in just 4M of launch in Sept18 💪🏽🚀(Probably the fastest growing credit product in 🇮🇳fintech market if not the world 🌎) pic.twitter.com/2bh0dFCQRC

— sampad swain (@sampad) January 2, 2019

Credits

- Next Day & Instant Payouts were envisioned and built by Manik Singla & Sampad Swain and is now managed by by Karthik Vajapeyajula. Insights shared in the post come from their analysis

- Product Designer - Sreenath Kotteri

- Thank you for proof-reading & editing - Harshad Sharma & Rapti Gupta

You are reading a post that I wrote a long time back—at least 5 years ago. Take it with a bag of salt.

About Sidharth · Listen to the Podcast · Talks